A Biased View of Feie Calculator

Table of ContentsLittle Known Facts About Feie Calculator.Some Known Factual Statements About Feie Calculator Feie Calculator - The FactsThe Single Strategy To Use For Feie CalculatorSome Known Factual Statements About Feie Calculator An Unbiased View of Feie Calculator6 Simple Techniques For Feie Calculator

If he 'd regularly taken a trip, he would certainly instead finish Component III, listing the 12-month duration he fulfilled the Physical Visibility Test and his traveling history. Step 3: Reporting Foreign Income (Part IV): Mark gained 4,500 per month (54,000 every year).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Since he resided in Germany all year, the percent of time he stayed abroad throughout the tax obligation is 100% and he goes into $59,400 as his FEIE. Mark reports complete earnings on his Type 1040 and goes into the FEIE as an unfavorable amount on Set up 1, Line 8d, reducing his taxable earnings.

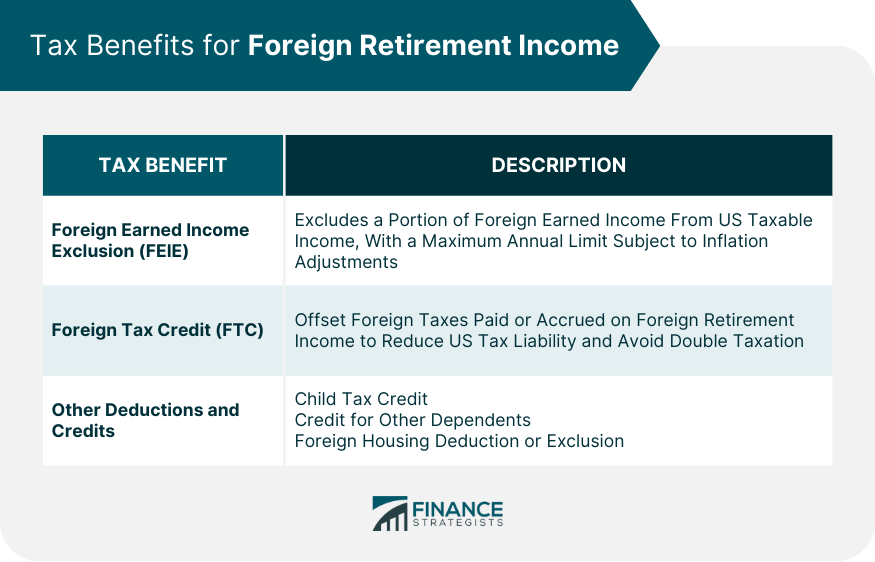

Selecting the FEIE when it's not the most effective choice: The FEIE may not be ideal if you have a high unearned income, make greater than the exclusion restriction, or live in a high-tax country where the Foreign Tax Obligation Debt (FTC) may be extra helpful. The Foreign Tax Credit Rating (FTC) is a tax decrease method usually used in conjunction with the FEIE.

Some Known Factual Statements About Feie Calculator

deportees to counter their U.S. tax obligation financial obligation with international earnings tax obligations paid on a dollar-for-dollar reduction basis. This suggests that in high-tax nations, the FTC can frequently get rid of U.S. tax obligation debt entirely. Nonetheless, the FTC has constraints on eligible tax obligations and the maximum case quantity: Eligible tax obligations: Only revenue tax obligations (or taxes instead of earnings tax obligations) paid to international federal governments are qualified.

tax obligation on your foreign income. If the international taxes you paid surpass this limitation, the excess international tax can generally be lugged forward for as much as 10 years or returned one year (through a changed return). Preserving exact records of foreign income and tax obligations paid is consequently vital to calculating the proper FTC and preserving tax obligation compliance.

migrants to reduce their tax responsibilities. If a United state taxpayer has $250,000 in foreign-earned revenue, they can omit up to $130,000 utilizing the FEIE (2025 ). The continuing to be $120,000 might after that be subject to tax, however the U.S. taxpayer can possibly use the Foreign Tax obligation Debt to balance out the taxes paid to the foreign nation.

How Feie Calculator can Save You Time, Stress, and Money.

He sold his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to aid meet the Bona Fide Residency Examination. Furthermore, Neil safeguarded a long-term home lease in Mexico, with plans to eventually purchase a building. "I presently have a six-month lease on a house in Mexico that I can prolong another 6 months, with the intention to purchase a home down there." Nevertheless, Neil explains that getting residential or commercial property abroad can be testing without initial experiencing the location.

"We'll definitely be beyond that. Also if we return to the United States for physician's appointments or company telephone calls, I doubt we'll invest greater than 1 month in the US in any type of provided 12-month duration." Neil emphasizes the value of rigorous tracking of U.S. visits. "It's something that individuals need to be truly attentive regarding," he claims, and advises expats to be careful of usual errors, such as overstaying in the united state

Neil is careful to anxiety to U.S. tax authorities that "I'm not performing any type of company in Illinois. It's simply a mailing address." Lewis Chessis is a tax obligation expert on the Harness system with comprehensive experience assisting U.S. citizens browse the often-confusing realm of global tax obligation compliance. One of the most common false impressions amongst united state

See This Report about Feie Calculator

income tax return. "The Foreign Tax obligation Credit history permits people functioning in high-tax nations like the UK to offset their united state tax liability by the quantity they have actually currently paid in tax obligations abroad," says Lewis. This ensures that expats are not taxed twice on the same income. Nonetheless, those in reduced- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The possibility of lower living expenses can be alluring, yet it typically includes compromises that aren't right away obvious - https://www.reddit.com/user/feiecalcu/?rdt=34074. Real estate, for example, can be more affordable in some countries, but this can indicate endangering on infrastructure, safety and security, or accessibility to trustworthy energies and solutions. Cost-effective properties may be found in areas with inconsistent internet, minimal public transport, or unreliable health care facilitiesfactors that can dramatically influence your daily life

Below are some of one of the most regularly asked concerns concerning the FEIE and other exemptions The International Earned Revenue Exclusion (FEIE) allows united state taxpayers to omit as much as $130,000 of foreign-earned earnings from government revenue tax, lowering their U.S. tax obligation liability. To receive FEIE, you need to fulfill either the Physical Presence Examination (330 days abroad) or the Authentic Home Examination (prove your primary home in an international country for an entire tax year).

The Physical Presence Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Presence Test also needs united state taxpayers to have both a foreign revenue and a foreign tax home. A tax home is specified as your prime location for organization or employment, regardless of your family members's residence. https://writeablog.net/feiecalcu/9d9y0tcl9g.

Not known Details About Feie Calculator

An earnings tax obligation treaty between the united state and an additional nation can help stop double taxation. While the Foreign Earned Earnings Exclusion reduces taxed income, a treaty may give extra advantages for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a needed declaring for U.S. citizens with over $10,000 in foreign monetary accounts.

The foreign earned revenue exemptions, in some cases referred to as the Sec. 911 exclusions, exclude tax on earnings gained from functioning abroad.

The 7-Second Trick For Feie Calculator

The tax obligation advantage leaves out the revenue from tax obligation at lower tax obligation rates. Formerly, the exclusions "came off the top" lowering income subject to tax obligation at the top tax rates.

These exemptions do not exempt the wages from United States taxation but simply supply a tax obligation decrease. Note that a bachelor functioning abroad for every one of 2025 who gained about $145,000 without any other income will certainly have taxed earnings reduced to absolutely no - properly the same answer as being "tax complimentary." The exemptions are calculated every day.

If you attended organization meetings or seminars in the United States while living abroad, revenue for those days can not be left out. Your salaries can be paid in the US or abroad. Your employer's location or the area where earnings are paid are not consider getting the exclusions. Digital Nomad. No. For US tax it does not matter where you maintain your funds - you are taxed on your globally earnings as a United States person.

Comments on “Feie Calculator for Beginners”